Reinventing the European Advanced Therapies Sector: An Interview with Eduardo Bravo

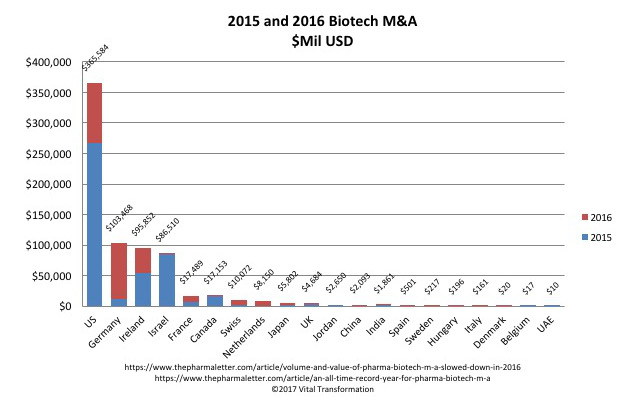

Mergers and acquisitions in the biotech sector in 2016 and 2017 show huge drop of activity in most EU countries since the beginning of the ‘great recession’. While there has been sizable volume in Germany, those numbers are a bit deceiving as they represent Bayer’s acquisition of Monsanto’s GMO unit for $66 bil, and Boehringer Ingelheim’s Swap for Sanofi’s Animal Health division of $25.3 bil, neither are mergers benefiting the EU production of human medicinal products.

Vital Transformation recently interviewed TiGenix CEO and President of the European Biopharmaceutical Enterprises (EBE) Eduardo Bravo on the implications of this lack of liquidity in Europe. He said,

“If you look at the number of specialized funds, banks and analysts in the biotech sector, Europe is in a negative spiral. You have less banks and fewer dedicated funds, so the companies have less cash and they need to go somewhere else. The result is less of a universe in the EU. The companies are then forced to follow the money.”

You can read the entire interview with Eduardo Bravo here