LATEST RESEARCH

Everybody Loses with Most Favored Nation Reference Pricing. . .Except China.

Key takeaways

If MFN were adopted in Medicare and Medicaid, based upon our preliminary estimate it could lead to 1.3 million fewer jobs over ten years.

$2.8 trillion in lost earnings over 10 years due to MFN being applied to Medicare, resulting in $700 billion in reduced tax revenue.

By undermining the U.S. economic environment, MFN risks accelerating the movement of U.S. biopharma research and development to China.

MORE RESEARCH

Inflation Reduction Act – Two Years On Investor Behavior, R&D Impacts, & Proposed Solutions

IRA has led to:

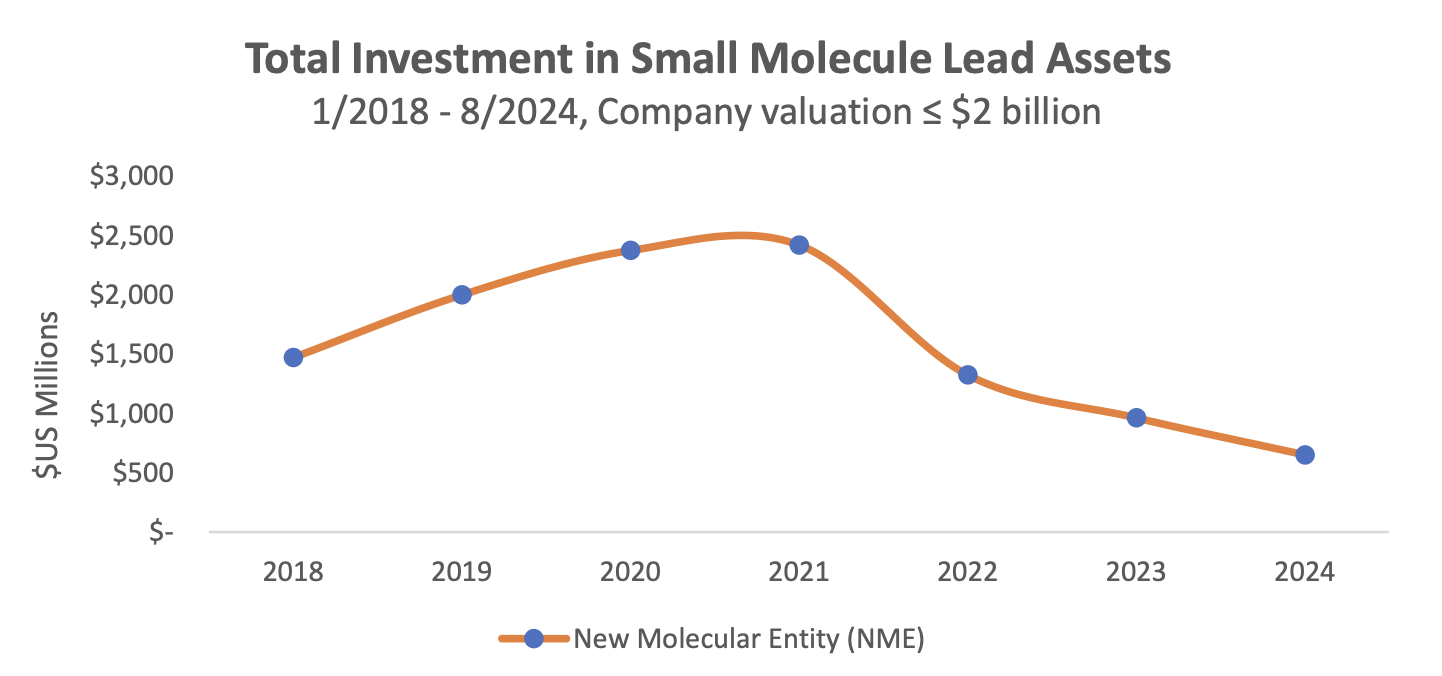

A 35% reduction in early-stage phase I and II therapies under development from 2021-2023 among small and midsize biotech companies as measured from IRA’s introduction; the average time of phase II and III development is roughly 40 months each, we would expect to see a considerable reduction in the number of FDA approvals in roughly 5 to 6 years.

A statistically significant reduction in the size of VC investments for small molecules with a high exposure to the Medicare-aged population, which is exposure above the mean at % above age 65, after the introduction of the IRA and no corresponding reduction in the size of VC investments for small molecules with a Medicare exposure below the mean.

A statistically significant reduction of > 70% in the median size of VC investments for small molecules treating indications with a high exposure to the Medicare-aged population in our cohort – these include Disease Dementia, Non-Small Cell Lung Cancer, Prostate Cancer, Multiple Myeloma and others.We also see a shift in the number of clinical trials from small to large molecules in areas with a high exposure to the Medicare-aged population, such as neurology and autoimmune disease classes.

When indications have exposure to the IRA’s impacts, we observe divergent results between large and small molecules; this presents statistically significant evidence of specific disincentives caused by the legislation for the Medicare-aged population.

Removing the ‘pill penalty’ by beginning IRA price setting for both small and large molecules after 13 years increases approvals targeting the Medicare-aged population by 20%.

Beginning IRA price setting after 15 years is estimated to reduce the number of medicines lost to the Medicare-aged population 50%.

PREPRINT NEW RESEARCH: The Inflation Reduction Act’s Impact upon Early-stage Venture Capital Investments

Vital Transformation is preparing a new analysis about the impacts of the Inflation Reduction Act on biopharma investment, research and development in the two years since the law’s passage. Early returns show significant harms to innovation and patients’ treatment options, particularly because of the IRA’s small molecule “pill penalty.”

The Impact of The House Proposed IRA Expansion on the US Biopharma Ecosystem

Vital Transformation (VT) modeled the impacts of the drug pricing provisions of the Inflation Reduction Act, with the expansions proposed by Representative Frank Pallone, Jr. (NJ-06) called the, “H.R. 4895: Lowering Drug Costs for American Families Act”, which would impose government price setting for up to 50 selected Medicare Drugs starting in 2029 and expand those negotiated prices to the commercial market.

We modeled the impacts on industry revenues, future R&D investments for the Medicare aged population, and lost innovation including industry jobs.

We estimate a loss of 136,000 – 216,000 direct biopharmaceutical industry jobs and 678,000 – 1,076,000 indirect jobs across the U.S. economy if H.R. 4895 were to be implemented.

We estimate that the expanded government price setting could result in roughly 134 fewer FDA approvals of new medicines treating primarily the Medicare aged population over a ten-year period:

- Impacts will be felt most heavily in many areas of unmet need, including in rare disease, oncology, neurology, and infectious disease targeting those over 65 years of age.

- H.R. 4895 impacts the entire commercial market at the point of negotiated prices entering Medicare.

- The most significant ecosystem impacts would be concentrated primarily in CA and MA.

- Had the drug pricing provisions of the House Bill H.R. 4895 been in place prior to the development of today’s top-selling medicines, we estimate that 76 of the 198 therapies we identified as selected for Medicare price setting would likely have not been developed.