IRA – Saving Money, or Playing Politics?

IRA’s drug negotiation choices seem to be much more about the 2024 election than Medicare cost savings in 2026.

By Duane Schulthess, John Lamattina, and Harry P. Bowen

September 13th, 2023

On Tuesday August 29th, the Biden Administration and the Centers for Medicare & Medicaid Services (CMS) announced the first 10 drugs to be selected as part of their signature legislation, the Inflation Reduction Act (IRA).

The linchpin of the IRA has been to lower total Medicare costs. The text of the IRA states clearly that the drugs to be chosen for negotiation are those, “… drugs with the highest total expenditures being ranked the highest.”[1] This language is completely unambiguous; drugs with the greatest total expenditures for taxpayers are the ones to be negotiated.

The IRA also includes provisions that drugs soon to be subject to generic or biosimilar competition are excluded from negotiation. This is logical as once a drug loses its patent exclusivity its price falls rapidly.

Our firm, Vital Transformation (VT), has been at the center of the IRA debate for well over a year. Given the IRA’s clear objective to contain taxpayer costs, we conducted economic modeling which simulated the impact of 10 years of IRA negotiations on Medicare spending and biopharmaceutical company revenues.[2]

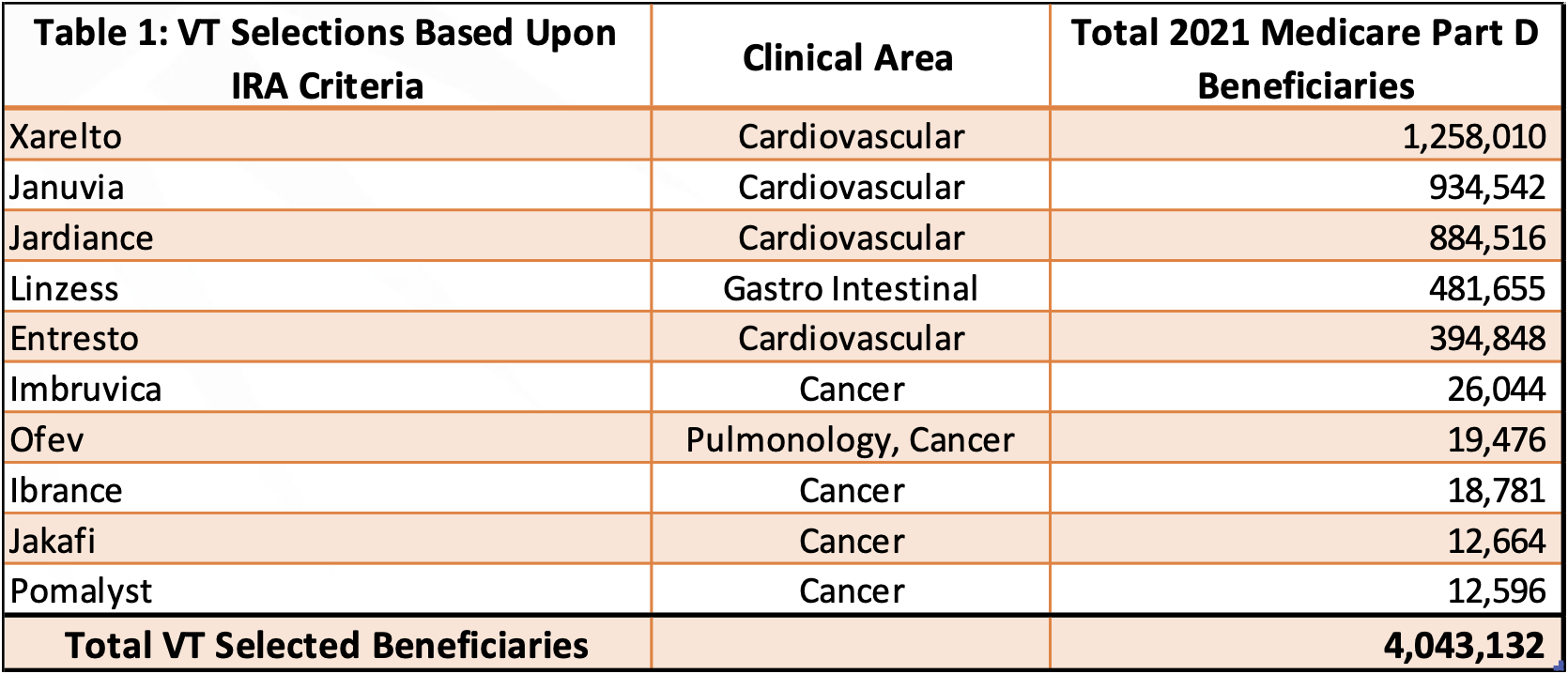

Our analysis was based squarely on the idea that drugs with the highest total expenditures lacking generic competition would be selected for negotiation (Table 1). Our analysis and findings have been referenced by the U.S. Congress, as well as in publications as diverse as Forbes, Boston Globe and Huffington Post.

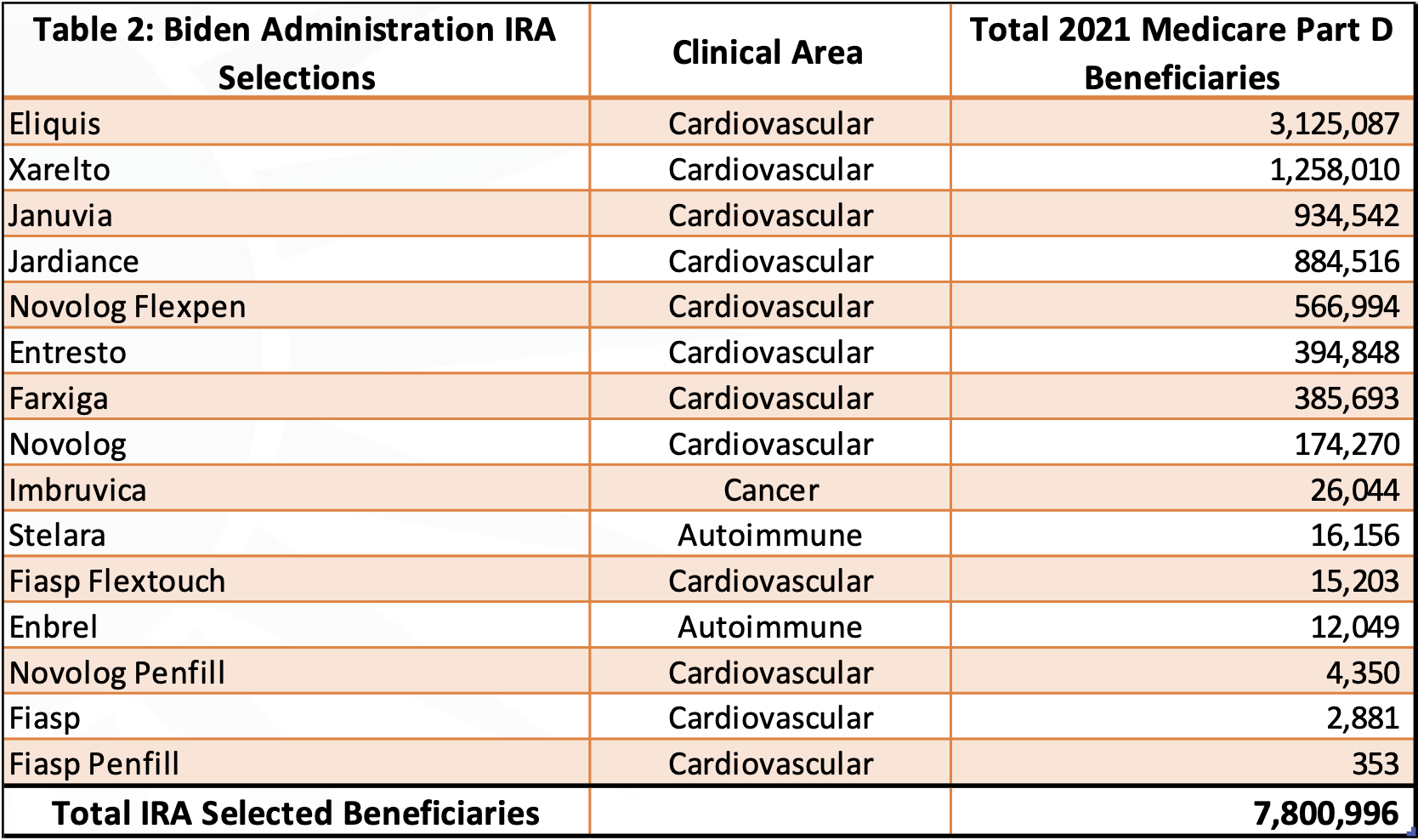

The recent announcement of the first 10 drugs subject to CMS price negotiations has us at VT scratching our heads (Table 2).

Eliquis’ generic entry is listed as 2028 due to patent settlements related to a Federal Court ruling; the FDA has already approved generics for the drug. However, the patent protection of Eliquis actually expires in 2026, according to BMS’ own report with the Securities and Exchange Commission.

With the implementation of the IRA, generic competition may actually benefit Eliquis from the standpoint of revenue, as it would then be excluded from price negotiations; the IRA alters the generics strategy of the originator. For this reason, we excluded it from our analysis as we assumed it would have generic competition in 2026.

For most of the 10 drugs ranking as CMS’ highest expenditures in VT’s analysis, the date of generic entry was obvious relative to 2026. For Eliquis, the existence of FDA approved generics simply waiting for a green light from the originator influenced our decision. However, in the cases of Xarelto and Pomalyst, it came down to our interpretation of generic competition in 2026, ongoing patent court cases, and the existence, or lack thereof, of FDA approved generics ready to launch.

The issue of how CMS interprets generic competition makes IRA extremely capricious, and creates enormous uncertainties for originating companies and investors. This is now doubly true in retrospect given the IRA’s actual negotiation selections. We are making adjustments in our future IRA modeling.

The inclusion of Farxiga, a cardiovascular treatment, is also strange; there are several cancer therapies that rank higher in terms of Medicare spending. In fact, it has been the high price of cancer therapies that has caught the ire of leading academics such as Vinay Prasad. The therapies selected to be negotiated within the IRA has a heavy bias towards cardiovascular treatments, not those targeting cancer.

Another oddity is the inclusion of six insulin-based diabetes treatments (Fiasp, Fiasp FlexTouch, Fiasp PenFill, NovoLog, NovoLog FlexPen and NovoLog PenFill) as ‘one product’ for negotiation. The IRA mandates that insulin is sold at a price of $35. In fact, many manufacturers have been proactively lowering their price of insulin to $35, even in the commercial market.

The $35 price cap for insulin implies most will rank low in terms of total Medicare costs. Given the IRA’s very clear mandate to choose drugs that represent the greatest expenditures, the inclusion of the bundle of six insulin-based diabetes treatments is puzzling.

One solution to this riddle is to look at the 10 (actually, 15) selected therapies from the standpoint of their Medicare beneficiaries, rather than their contribution to total Medicare expenditures. That is, to see these choices in terms of spheres of influence and people impacted, rather than total costs and generic competition.

Vital Transformation did not consider the total number of people that each therapy treats in our initial analysis. When we do retrospectively, we find that the drugs on our list treat roughly 4 million Medicare beneficiaries. But when we look at the drugs selected by the Biden Administration, the number of Medicare beneficiaries covered is almost twice as large, with 7.8 million people.

Even if we’d also chosen to include Eliquis in our analysis, the IRA therapies selected for negotiation would have 10% more beneficiaries.

Undoubtedly, IRA will play a key role in the 2024 reelection efforts of the Biden Administration, regardless if this strategy is implied or overt. Given this, it is interesting to consider President Biden’s 2020 razor-thin margin of victory of 44,053 votes in the key swing states of Nevada, and Arizona.

These states are likely to be vital to any 2024 election victory – they are also, not shockingly, booming in population due to an influx of retirees. According to the New York Times, “The over-65 population increased 52 percent in Arizona between 2009 and 2019; it grew 57 percent in Nevada.”

It is certainly plausible that the Biden Administration is selecting therapies for negotiations to maximize their voter impact in the upcoming 2024 election – put simply, there are many more cardiovascular patients in the US than cancer patients. It would be a shame if cynical politicking was influencing the IRA’s drug selection decisions, but the current choices make more sense in this context, rather than on the long-term economic savings as clearly specified as the core objectives written into the IRA law itself.

[1] https://www.congress.gov/bill/117th-congress/house-bill/5376/text

[2] Data drawn from https://data.cms.gov/summary-statistics-on-use-and-payments/medicare-medicaid-spending-by-drug/medicare-part-d-spending-by-drug

Duane Schulthess is the CEO of Vital Transformation, a Belgium and Washington, D.C.-based health consultancy firm. John Lamattina is the past President of Pfizer Global R&D, the author of several well-known books on the biopharmaceutical sector, and a contributor to Forbes. Harry P. Bowen is Vital Transformation’s consulting economist, and the W.R. Holland Chair of International Business and Finance at Queens University of Charlotte. Joseph Hammang and Gwen O’Loughlin also contributed to this article.