Vital Transformation understands the implications of new medical procedures, technologies and policies. We measure their impact on current clinical practices in close collaboration with health care professionals, researchers, and regulators. Through our web platform and client network, we are able to communicate our findings with international decision makers and stakeholders. Vital Transformation has presented or participated in conferences sponsored by The Royal College of Physicians, European Health Forum Gastein, The European Commission, London Genetics, The European Science Foundation, The European Microelectronics Summit, and others. Our Vital Transformation branded round-tables, webinars, and conferences are often oversubscribed, and are regularly presented in partnership with global thought-leaders and organisations.

OUR RESEARCH

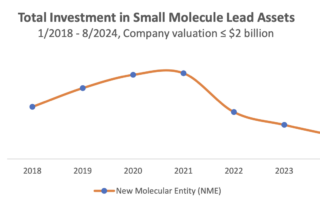

PREPRINT NEW RESEARCH: The Inflation Reduction Act’s Impact upon Early-stage Venture Capital Investments

Vital Transformation is preparing a new analysis about the impacts of the Inflation Reduction Act on biopharma investment, research and development in the two years since the law’s passage. Early returns show significant harms to innovation and patients’ treatment options, particularly because of the IRA’s small molecule “pill penalty.”

The Impact of The House Proposed IRA Expansion on the US Biopharma Ecosystem

Vital Transformation (VT) modeled the impacts of the drug pricing provisions of the Inflation Reduction Act, with the expansions proposed by Representative Frank Pallone, Jr. (NJ-06) called the, “H.R. 4895: Lowering Drug Costs for American Families Act”, which would impose government price setting for up to 50 selected Medicare Drugs starting in 2029 and expand those negotiated prices to the commercial market.

We modeled the impacts on industry revenues, future R&D investments for the Medicare aged population, and lost innovation including industry jobs.

We estimate a loss of 136,000 – 216,000 direct biopharmaceutical industry jobs and 678,000 – 1,076,000 indirect jobs across the U.S. economy if H.R. 4895 were to be implemented.

We estimate that the expanded government price setting could result in roughly 134 fewer FDA approvals of new medicines treating primarily the Medicare aged population over a ten-year period:

- Impacts will be felt most heavily in many areas of unmet need, including in rare disease, oncology, neurology, and infectious disease targeting those over 65 years of age.

- H.R. 4895 impacts the entire commercial market at the point of negotiated prices entering Medicare.

- The most significant ecosystem impacts would be concentrated primarily in CA and MA.

- Had the drug pricing provisions of the House Bill H.R. 4895 been in place prior to the development of today’s top-selling medicines, we estimate that 76 of the 198 therapies we identified as selected for Medicare price setting would likely have not been developed.

PODCASTS

NEWSLETTER

Register now to receive all the latest updates from Vital Transformation including our research, podcasts and more…

Our clients include many of the world’s leading health care organisations.