Vital Transformation is a small, unique consultancy focused on addressing the challenges of today’s modern healthcare system. We partner with your organisation to help you find answers to hard to solve problems.

Contact us to learn how Vital Transformation can help your organisation.

LATEST RESEARCH

Most Favored Nation (MFN) Reference Pricing in Medicare: Impacts on jobs, innovation, and state budgets

- The Most Favored Nation (MFN) policy uses the lowest international adjusted price for medicines across a select basket of countries to set drug prices in the U.S. market (the “MFN Price”).

- Assuming the top 50 drugs by spending in each of Medicare Parts B and D are impacted by an 85% gross price reduction due to MFN, which would also then spillover into Medicaid, 340B, and hospital ASP’s, we would expect to see the following impacts between 2025 - 2034:

- A loss of 1.98 to 2.22 million jobs, representing 40% of current U.S. jobs in the biopharmaceutical industry, with 472,000 being employed directly and 1.7 million being employed indirectly.

- The largest job losses would occur in California, Florida, Texas, and New York.

- A loss of $600 billion in federal tax revenue and over $450 billion state tax revenue.

- A loss of up to $2.4 trillion in earnings generated by the biopharma sector.

- Spillover impacts of MFN into Medicaid, 340B and ASP +6 payments represent more than 600,000 of the total jobs lost.

- A sensitivity analysis restricting the impacts of MFN to roughly half of the net price reduction was also calculated finding the loss of nearly 1.03 million jobs, assuming spillover effects.

- MFN will lead to an annual reduction in ASP payments to hospitals from $2 billion to $700 million; losses of this size would lead to the closure of many community and rural treatment centers.

- With an 85% reduction in the gross U.S. prices due to MFN, we would also expect to see the following reductions in U.S. Biopharma Key Performance Indicators:

- The disappearance of nearly all VC funding for early and late-stage companies.

- A 48% reduction in authorized biopharma patents.

- MFN will increase the risks to U.S. economic security by incentivizing the competitiveness and growth of China’s biopharma sector.

LATEST COMMUNICATIONS

Our Communication Services

In this episode of the Vital Health Podcast, host Duane Schulthess examines how NIH-funded research fits into the U.S. innovation and IP ecosystem, and why today’s political rhetoric about “government-developed drugs” often misses how commercialization actually happens. Featuring expert perspectives on NIH technology transfer and drug IP from:

-

Mark Rohrbaugh: Former Director of Technology Transfer and Innovation Policy at the National Institutes of Health (NIH), IP Consultant at Vital Transformation

-

Gwen O’Loughlin: Research Partner at Vital Transformation

Find all our communication projects on Better Science, Better Health

MORE RESEARCH

Everybody Loses with Most Favored Nation Reference Pricing. . .Except China.

Key takeaways

If MFN were adopted in Medicare and Medicaid, based upon our preliminary estimate it could lead to 1.3 million fewer jobs over ten years.

$2.8 trillion in lost earnings over 10 years due to MFN being applied to Medicare, resulting in $700 billion in reduced tax revenue.

By undermining the U.S. economic environment, MFN risks accelerating the movement of U.S. biopharma research and development to China.

Inflation Reduction Act – Two Years On Investor Behavior, R&D Impacts, & Proposed Solutions

IRA has led to:

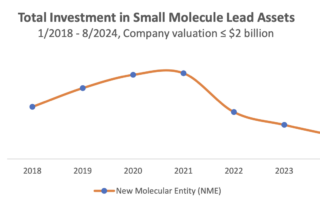

A 35% reduction in early-stage phase I and II therapies under development from 2021-2023 among small and midsize biotech companies as measured from IRA’s introduction; the average time of phase II and III development is roughly 40 months each, we would expect to see a considerable reduction in the number of FDA approvals in roughly 5 to 6 years.

A statistically significant reduction in the size of VC investments for small molecules with a high exposure to the Medicare-aged population, which is exposure above the mean at % above age 65, after the introduction of the IRA and no corresponding reduction in the size of VC investments for small molecules with a Medicare exposure below the mean.

A statistically significant reduction of > 70% in the median size of VC investments for small molecules treating indications with a high exposure to the Medicare-aged population in our cohort – these include Disease Dementia, Non-Small Cell Lung Cancer, Prostate Cancer, Multiple Myeloma and others.We also see a shift in the number of clinical trials from small to large molecules in areas with a high exposure to the Medicare-aged population, such as neurology and autoimmune disease classes.

When indications have exposure to the IRA’s impacts, we observe divergent results between large and small molecules; this presents statistically significant evidence of specific disincentives caused by the legislation for the Medicare-aged population.

Removing the ‘pill penalty’ by beginning IRA price setting for both small and large molecules after 13 years increases approvals targeting the Medicare-aged population by 20%.

Beginning IRA price setting after 15 years is estimated to reduce the number of medicines lost to the Medicare-aged population 50%.

PREPRINT NEW RESEARCH: The Inflation Reduction Act’s Impact upon Early-stage Venture Capital Investments

Vital Transformation is preparing a new analysis about the impacts of the Inflation Reduction Act on biopharma investment, research and development in the two years since the law’s passage. Early returns show significant harms to innovation and patients’ treatment options, particularly because of the IRA’s small molecule “pill penalty.”

VITAL HEALTH PODCASTS

Our podcast series is also available via your favourite channels!

|

|

|---|---|

|

|

NEWSLETTER

Register now to receive all the latest updates from Vital Transformation including our research, podcasts and more…

VT on X

Claims that the IRA wouldn’t affect innovation overlooked how early-stage investors really make decisions. Our research shows the pipeline for senior-focused therapies is already narrowing.

— VitalTransformation (@VitalTransform) April 18, 2025

Read the full breakdown: https://t.co/4EzJGdMcU4@weworkforhealth #IRA #DrugPricing

The IRA’s 9-year cap for small molecules and 13-year cap for biologics rerouted investment away from the pills seniors rely on. We sat down with @steveusdin1 to unpack how this shift skews R&D incentives and future therapies.

— VitalTransformation (@VitalTransform) April 27, 2025

Listen here: https://t.co/FCjKFdIhsU@weworkforhealth pic.twitter.com/phoDI4ZrhK

Our clients include many of the world’s leading health care organisations.