PREPRINT NEW RESEARCH: The Impact of MFN on Oncology and Hematology Treatments

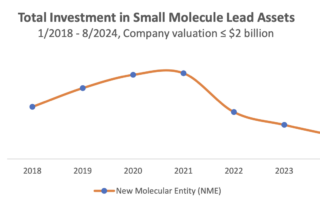

Vital Transformation is preparing a new analysis about the potential implications of Most Favored Nation (MFN) drug pricing policies for the U.S. oncology ecosystem, focusing on how international reference pricing could reshape provider economics, patient access, and innovation incentives. The analysis models the effect of benchmarking U.S. prices for cancer medicines against lower prices in selected peer countries and estimates substantial reimbursement reductions across multiple therapies.